You are here: The State of the Property Market. (Are we heading for a storm?)

JJ Heath-Caldwell, Managing Director of Local Surveyors Direct gives his views on the current state of the property market, and where this could lead

Around 16 years ago, in the financial crisis of 2007-2008, we had a sudden downturn in the property market and we had an even larger downturn 20 years earlier (35 years ago) in the financial crisis of 1987-1990. However, these events are such a long way back in time that anyone under the age of 35 has no memory of a crash in the property market. Most of their experience is of house prices always going up!

So, looking forward, are we about to see a big drop in economic activity and in particular are we going to see a major decrease in house values? My own feeling is that we are going to see a lot of difficulties in the economy, in particular the cost of imported food is likely to increase greatly. The price of oil has also been rising. We are also likely to see an increase in strikes and industrial action as everyone tries to get pay rises in line with inflation. The problems that we will see in the UK economy could have some similarity to the 1970s (those of us over the age of 60 can remember that far back!).

Taking my best guess, I think over the coming 12 months we will see the property market quieten. I think the value of houses will stabilise and in real terms probably go down slightly.

In more detail, the following is a bit of history and some general points that lead me to the above conclusion.

Interest rates

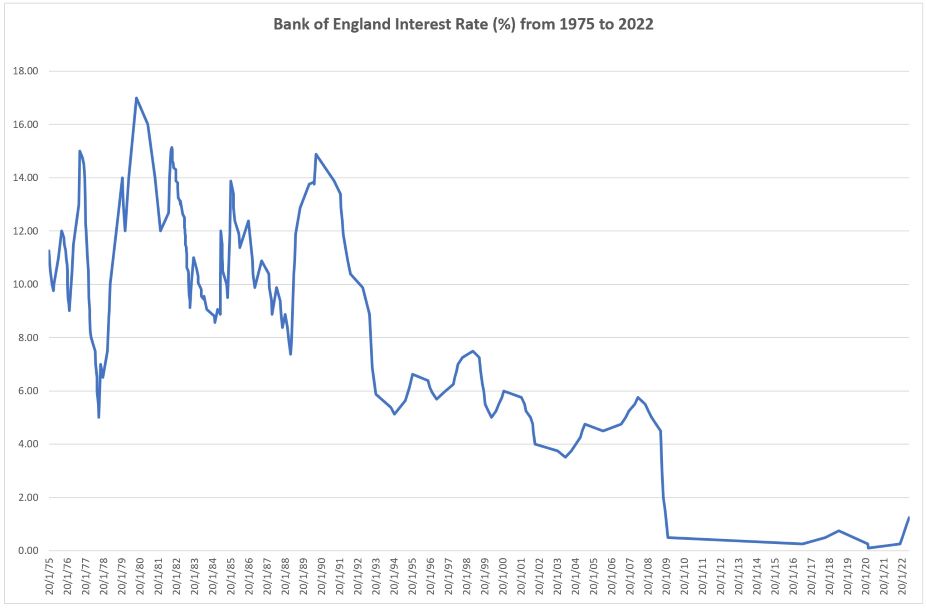

Back in 1979 the Bank of England base interest rate peaked at 17% and then reduced but stayed above 7% up until the financial crisis of 1987-1990 when it peaked again (14.88%, 1989). After a few years it dropped and settled into a range between 4% and 7% for over a decade until the financial crisis of 2007-2008 when it dropped significantly and then remained low. In 2020 it dropped even further to the amazingly low rate of 0.1% where it remained until the end of 2021. Today (1 July 2022) it has come up slightly but is still at the incredibly low rate of 1.25%.

Interest rates are increasing in most other countries, and this also affects us because the Bank of England has to respond with further increases here in the UK. The Bank of England has to consider exchange rate and inflation and respond with changes to the interest rates in an attempt to keep the UK economy as stable as possible.

I think it is safe to assume that interest rates are likely to rise. This means that the cost of borrowed money will increase, homebuyers will get smaller mortgages and there will be less money to buy houses.

Data from bankofengland.co.uk/

House Prices

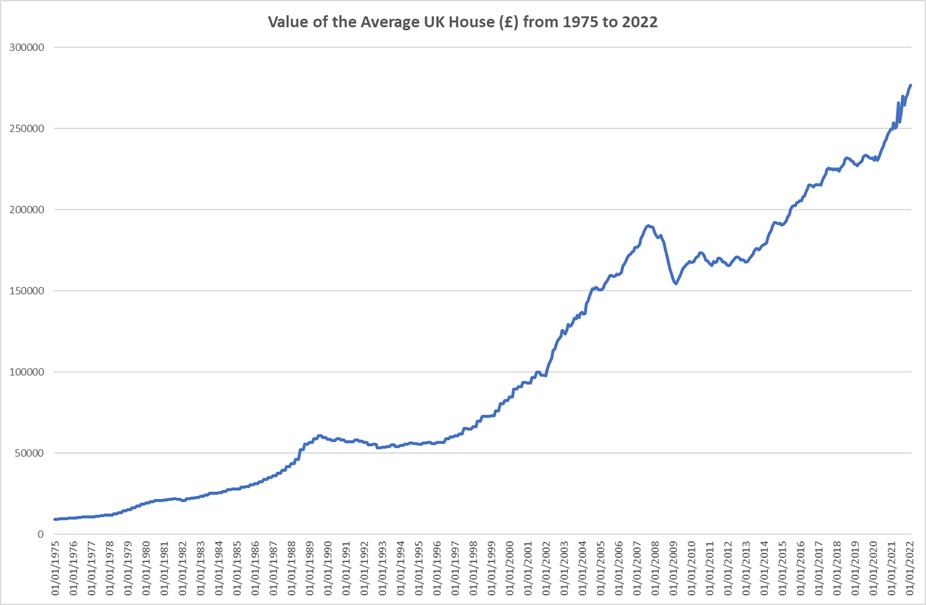

House prices steadily rose (above the rate of inflation) through the 1980s but this rise momentarily stopped after the financial crisis of 1987-1990 when it became more difficult to borrow money. House prices remained low for a few years after which they once more increased until the financial crisis of 2007-2009 when borrowing money once again became difficult. Prices dropped for a few years and then from 2015 they started going up again. If you compare the price of the average house in 1980 with today’s price (2022) the increase has been 1297%. Even if you take away the effect of inflation you can see that the price of houses in real terms has increased substantially.

I think it is a safe to assume that the price of the average house is unlikely to rise over the next few years in real terms but will possibly rise because of inflation.

Data from landregistry.data.gov.uk

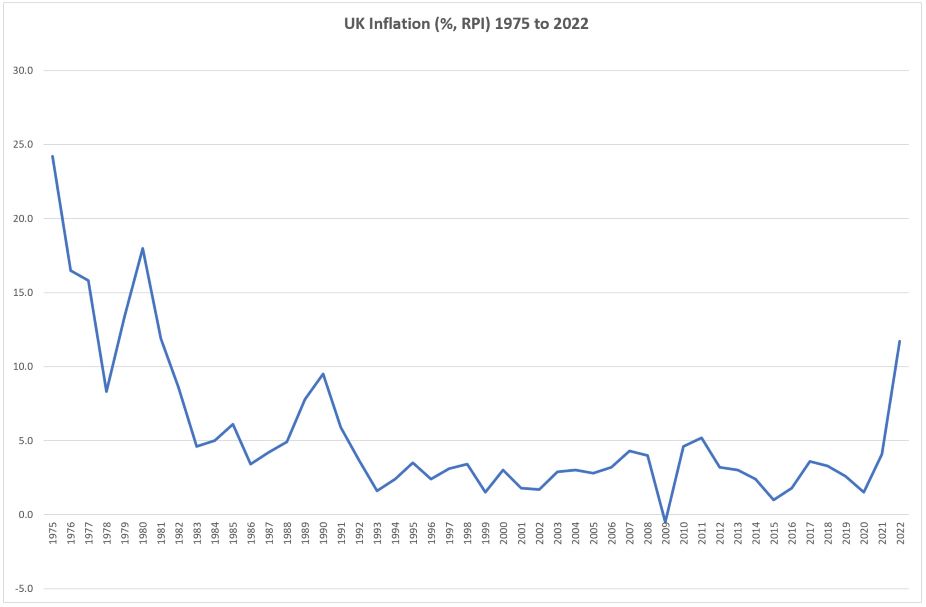

Inflation

Inflation in the 1970s was rampant and peaked at 24% in 1975. By 1980 it was 18% and from there it dropped to around 5% until the financial crisis of 1987-1990 when inflation peaked at around 10%. From there it has all been downhill and has averaged around 3% up until the last 12 months when it has shot up and in May 2022 was at 9.1% (CPI) or 11.7% (RPI).

In 1980 the average house cost £20,897. Adjusting for inflation to bring this into 2021 money, the value would be approx £74,110. However, the price of the average house at the end of last year was £271,046. This means that in real terms, the price of a house over this period of 42 years has actually increased by approx 366% (not 1297%).

https://www.bankofengland.co.uk/monetary-policy/inflation/inflation-calc...

Every year for the last two decades I have assumed that the price of houses would not continue to rise and I have consistently been wrong! However, as I have noted above, I think it is safe to assume that the price of houses is unlikely to rise significantly over the next few years. The value of houses might stabilise or even rise slightly in digit terms but if inflation is taken into account, my feeling is that the real value of houses will not increase.

What about the value of money sitting in a bank account? If you have money in the bank attracting an interest rate of 1% and inflation is running at 10% then the real buying power of your money will be decreasing at approx 9% every year.

Data from ons.gov.uk

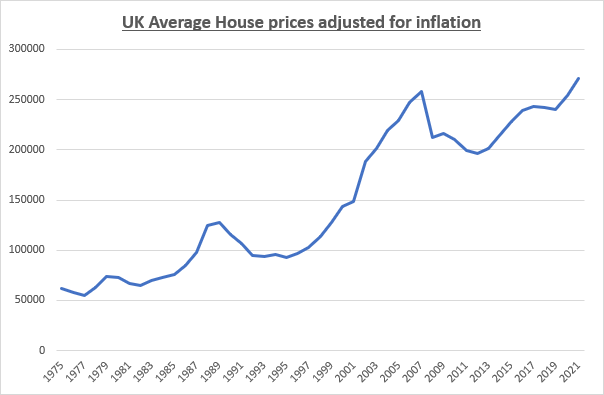

House prices adjusted for inflation

Here is the graph when we adjust the price of houses for inflation. In other words we have adjusted the value in each year to represent 2021 prices. The value given to houses in 1975 is substantially increased. The result is interesting as you can see that in each of the last two property crashes the drop was similar (approx 25%) and the time from the peak to the bottom was similar (approx 5 years).

The Price of Food

We all need a regular and reliable supply of food. This is a basic necessity and we cannot survive without it. In our lifetimes the cost of food has been relatively cheap (when compared to the costs in Victorian times). It is difficult to get accurate data for the price of food, but it is fairly obvious that the price of food prior to 2020 had been increasing. The Covid pandemic disrupted transportation logistics and this is now causing delays and shortages. The War in Ukraine is also having a detrimental impact on food supply. World population is now approx 7.8 billion and it is increasing by approx 1 million every 5 days. The area on the planet to grow food is not increasing. With the effects of global warming, food production in the equatorial regions of the planet is likely to decrease. In summary the demand for food is rising internationally. It is likely that the supply of food from our planet will not be able to meet this increasing demand. In the words of the chairman of the Bank of England this situation could be ‘apocalyptic’. If people have to spend more of their income on food, they will have less money to buy houses. This will contribute to making house prices lower than they otherwise would have been.

Supply and Demand for Houses

The demand for houses is mainly determined by the number of people in the UK needing somewhere to live (renting or owning). The supply of houses is determined by the number of houses that already exist and the number of houses being built. Getting planning permission to build a house is slow and expensive. Getting a new house building project underway, large or small, can take many years. It is assumed that the number of new houses being built in the UK every year is approx 200,000 but it is difficult to know for sure.

The population of the UK is assumed to be around 68 million (2022) but a reliable figure is difficult to know as even the UK government does not have accurate data on this. The number of people immigrating to the UK each year has been increasing and in 2021 it would appear that it was almost 1 million. At the same time some people also leave the UK but the net population gain per year is probably somewhere around 400,000. With global warming and over population of the planet, food is running out in some countries and as a result a very large number of people have no option but to leave their country and find a better country to live in. Many of these people see the UK as a suitable place and hence it is safe to assume that the number of people coming to live in the UK is going to substantially increase. It is very difficult to predict how many immigrants will decide to come to the UK over the next few years but we can be fairly certain that the number will be very large.

It should be noted that in the UK we only produce food for approx 40 million people and with a population of 68 million we have to import food for approx 28 million. These numbers are very hard to estimate but nevertheless, we know we will have to import even more food in the future. As the cost of this imported food rises the impact on the UK economy will be bad news.

In the short term, lots of immigrants coming to the uk is great for the economy because a large number of these individuals are resourceful people who are happy to work and pay tax. However, increasing population is likely to be detrimental in the long term. As the price of food goes up things could become dire (apocalyptic).

Regarding the property industry, increasing population is good news as all these people need somewhere to live and hence they generate lots of activity in the housing market (renting and buying). Lots of work for surveyors, architects, builders, energy assessors, estate agents, structural engineers, electricians, plumbers etc.

As a general rule, if the supply of new houses does not keep up with the increase in population, the result will be that the prices of houses will rise.

Government Policies

From time to time the government introduces new policies and makes changes to existing policies. Increasing student loan repayments mean that young people have less money to buy homes. Schemes like ‘Help to Buy’ help young people buy homes. Stamp duty holidays for first time buyers make homebuying more affordable. Increased stamp duty of second homes discourages people from owning more than one property. Company tax laws make it more economic for landlords to own rental properties when compared to owner occupiers who are not able to gain equivalent tax advantages.

This is a complex area to analyse but we can be certain that the government will make future changes from time to time and these will have an effect on the property market.

Policies of Loan Providers

Banks and building societies all have rules and procedures when loaning money. If they change any of their rules then this can increase or reduce the amount of money that can be loaned. For example, most lenders will look closely at the LVR (Loan to Value Ratio) as they want to be reasonably sure that they will not lose their money. Provided the property is worth a lot more than the amount of money loaned then no problem. If the LVR is 60% then the loan is fairly safe. If the LVR is 90% then the lender will charge a higher rate of interest to reflect the fact that the loan is more risky.

Another ratio is the mortgage multiplier. Most lenders these days will allow homebuyers to borrow up to 4.5 times their salary. Back in the 1980s the multiplier was 3. The increase in the multiplier over the years has meant that buyers have been able to borrow more money and hence the price of houses has gone up.

If the lenders suddenly change their requirements on LVR, or on mortgage multiplier, then this immediately changes the amount of money available and so the price of houses also changes.

Other loans

Back in the 1970s very few people went to university and for most of them it was paid for by the taxpayer. We now have 50% of students going onto higher education and they take out a government loan to pay for this. The average amount owed by a student who has completed a three year degree is now somewhere around £45,000. These graduates will all be potential homeowners in the future but they will have less money available to buy a house.

During the Covid pandemic the government made a large number of loans available to help people through the downturn in the economy. Many of these loans will remain unpaid for quite some time and in each case the borrower will be less able to buy a house.

If there are less people able to borrow money and buy a house the result will be that the price of houses will be lower than it otherwise would have been.

Sometimes people have to sell

Regardless of any downturn in the property market, there will always be some homeowners who are in a position where they need to sell. In particular, situations involving death, divorce and debt. In a lot of cases these sellers are in a hurry and most will take the first reasonable offer (but not always). The alternative to selling a property in a low market is to keep it and rent it out hoping the value of the property will again rise in the future. For many owners, selling at a low price is just not acceptable and so they will sometimes take the house off the market and become landlords.

Recent observations

The latest government figures indicate that UK residential transactions in May 2022 was 100,870, which was 2.0% lower than May 2021. This would indicate that the activity in the UK is possibly starting to reduce slightly but this figure could be corrected upwards as the government gets more data over the next few months.

https://www.gov.uk/government/statistics/monthly-property-transactions-c...

Information on the value of new mortgages for residential properties in the UK is published by the FCA (Financial Conduct Authority) and these note the market looking strong at the end of March 2022 but we will have to wait a while for data from the last few months.

https://www.fca.org.uk/data/mortgage-lending-statistics

The Local Surveyors Direct websites processes approx 350,000 enquiries for property services every year. These are predominantly enquiries for building surveys from customers who are in the process of buying a house. In the early stages of the Covid pandemic in 2020 the demand for property services reduced significantly but then shot up. By the beginning of 2021 the activity had become very strong but over the last 12 months there has been a gentle decline in numbers.

Looking at the most recent daily figures (June 2022), indications are that activity in the property market is now on the decrease but only slightly. My best guess is that the market will drop further but probably not by much simply because the rapidly growing UK population will mean significant continuing demand.

Article written by JJ Heath-Caldwell

If you are looking for a Surveyor, you may find some of these links useful:

Building Surveys

I want a local surveyor to do a Building Survey for me

Homebuyer Survey

I want a local surveyor to do a homebuyer survey for me

Home Condition Surveys

Find local experts and compare prices

Valuation Surveys

If you need a Valuation Survey

Scottish Home Reports

Find local experts and compare prices

Asbestos Surveys

I want to find a local surveyor to do an Asbestos Survey for me

CCTV Drain Survey

If you are looking for a CCTV Drain Survey

Electrical Reports

Find an Electrician to produce an Electrical report (sometimes known as an Electrical Installation Condition Report - or EICR) for a property.